child tax credit october 2021 date

This tax credit is changed. Enter the total from Form 109 Side 3 Schedule B Tax Credits line 4.

Child Tax Credit Schedule 8812 H R Block

Line 17 Withholding Form 592-B.

. Enter the total amount of estimated tax payments made during the 2021 taxable year on this line. These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. If you and your spouse are both educators or teachers and your filing status is Married Filing Jointly you.

OYour 2019 tax return including information you entered into the Non-Filer tool on. If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you could claim a tax credit of either. Final date to update information on Child Tax Credit Update Portal to impact advance Child Tax Credit payments disbursed in December.

Appreciated assets including long-term appreciated stocks or property is generally deductible at fair market value not to exceed 30 of your adjusted gross income. Attach all credit forms schedules or statements and Schedule P 100 or 541 if applicable to Form 109. Also for Tax Year 2021 Tax Returns your cash donation to a public charity cannot exceed 60 of your AGI or adjusted gross income in order to be deductible on your income tax return.

50 of all qualifying expenses up to a maximum of 4000 for one childdependent. The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. For Tax Year 2021 teachers or educators can generally deduct unreimbursed out-of-pocket school trade or educator business expenses up to 250 on their federal tax returns using the Educator Expense DeductionYou do not have to itemize your deductions to claim this.

Designed to provide the most up-to-date information about the credit and the advance. Frequently asked questions about the Advance Child Tax Credit Payments in 2021 Topic A. We estimate your 2021 Child Tax Credit based on information on your processed 2020 tax.

Line 16 2021 Estimated Tax.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

When Are Taxes Due In 2022 Forbes Advisor

How Germany Plans To Increase Child Benefits And Provide Tax Relief

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

ब एमआरस एल म नच त र Namma Metro Metro Chart

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

2021 Us Tax Deadlines Expat Us Tax

The Big Longs Of The Big Short Hero The Big Short Michael Burry Company Values

Pin By Tax Consultancy On Tax Consultant Tax Deductions Bank Statement 1st Bank

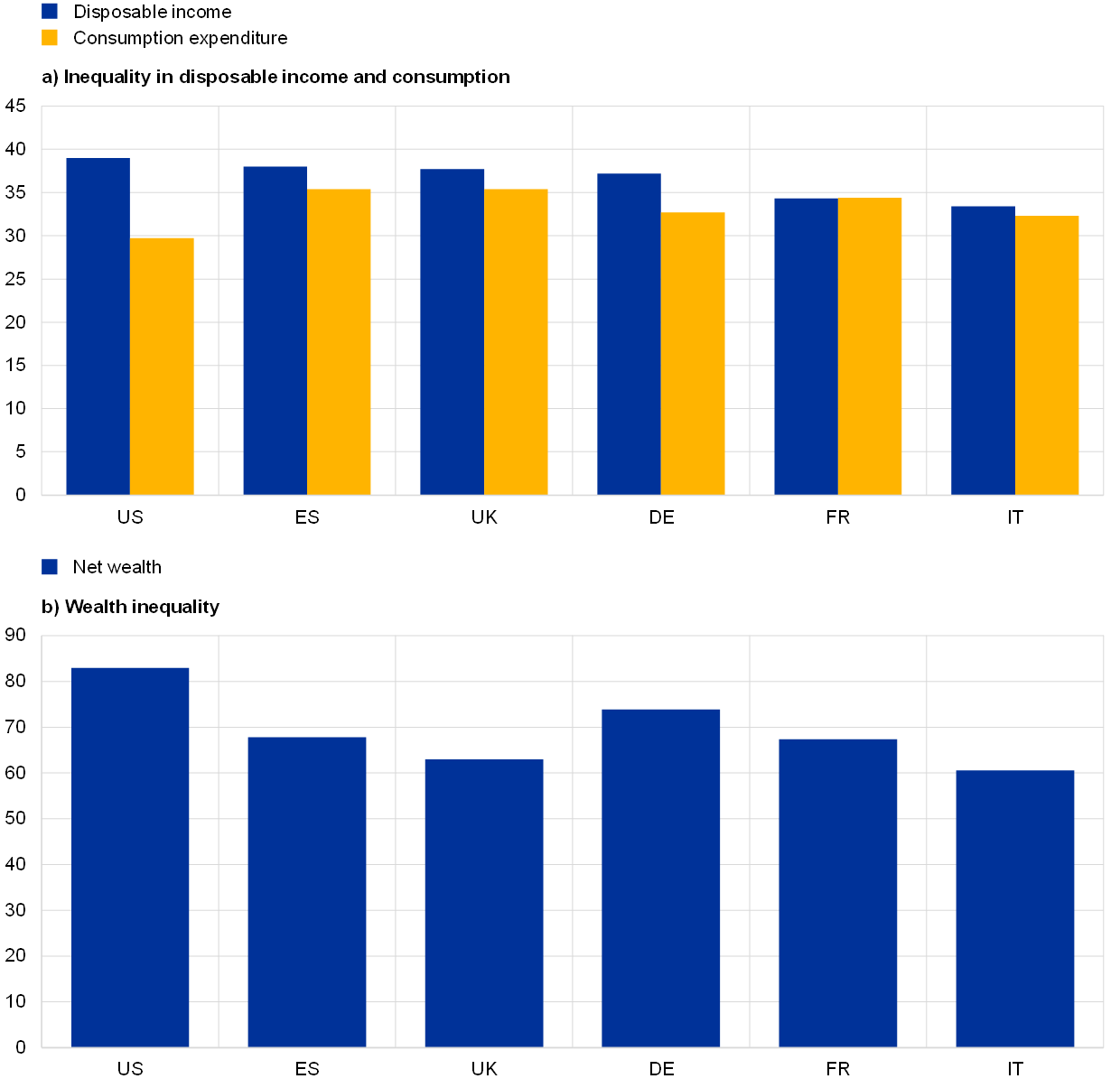

Monetary Policy And Inequality

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2021 8 Things You Need To Know District Capital

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet